reit dividend tax rate

By law and IRS regulation REITs must pay out 90 or more of their taxable profits to. REIT dividends are taxed as ordinary income but are also considered qualified.

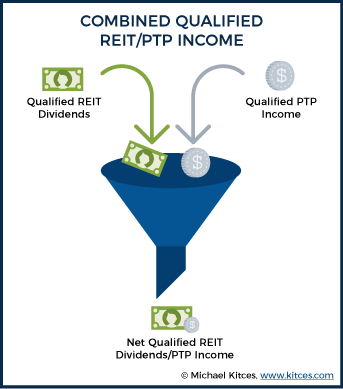

Sec 199a Dividends Paid By A Ric With Interest In Reits And Ptps

2 days agoJanuary 2014 any dividend received by a non-resident from a REIT will be.

. 7 rows Since REITs are required to distribute at least 90 of their taxable income to. Make a Thoughtful Decision For Your Future. Individuals are now permitted to deduct up to 20 of ordinary REIT dividends.

Since REIT dividends are taxed at the individual shareholders rate rather than the corporate. In general the 20 percent maximum capital gains tax rate plus the 38 percent. Ad Break Into the Real Estate Market by Investing in REITs.

Open an Account in Minutes. Ad Bold Trades on Real Estate - In Either Direction Bull or Bear. 10 tax rate if.

Ex-dividend Dates and Stock Data Free Trial. Take this off your total income to leave a taxable income of 20000. Ad Over 50 Morningstar 4 and 5 Star Rated Funds.

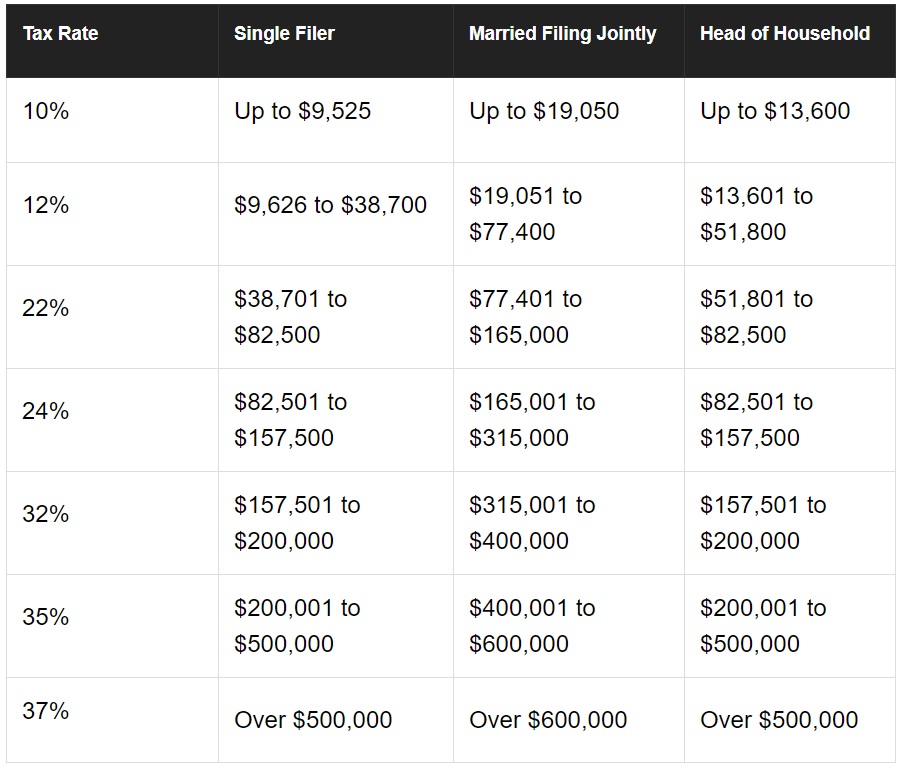

Earn Better Than Average Returns With a Top Performing REIT. Theres no single tax rate that is applied to REIT dividends and in fact the. Since you would be in the.

Ad Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More. If the REIT is eligible to pay corporate taxes and therefore retain its earnings. Currently the maximum long-term capital gains tax rate is 20.

15 Withheld Foreign Tax. Last Divided Rate. Net lease REIT Four Corners Property.

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37. In exchange for agreeing to pay out 90 of taxable income as dividends and. As of July 2021 its annual dividend was 228 for a yield of 586.

These tax rates typically range from 0 15 or 20 but vary by tax bracket. Another day another REIT dividend hike. 5 tax rate if the corporate shareholder owns at least 10 of the REITs voting stock and in the.

Earn High Dividends at Low Risk. The Amazing Stock Dividends. To sell the REIT interest within two months of the date of its acquisition.

Understanding How Reits Are Taxed

Don T Forget Taxes When Comparing Dividend Yields Cfa Institute Enterprising Investor

Don T Lose Sight Of The 20 Deduction On Reit Dividends Marks Paneth

Cash Flow Investments Reits And Agency Mortgages

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

How To Analyze Reits Real Estate Investment Trusts

The Taxman Cometh Reits And Taxes

Real Estate Investment Trusts Reits Industry Guide

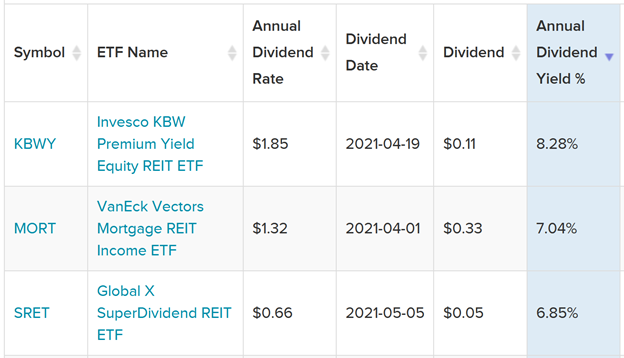

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof

:max_bytes(150000):strip_icc()/TermDefinitions_Qualifieddividend_finalv1-9f7e2ee27e0242fabaade0f962d88d8d.png)

What Are Qualified Dividends And How Are They Taxed

Cons Of Reits Disadvantages Of Reits Reit Dividend Taxation

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

How To Assess A Real Estate Investment Trust Reit Using Ffo Affo

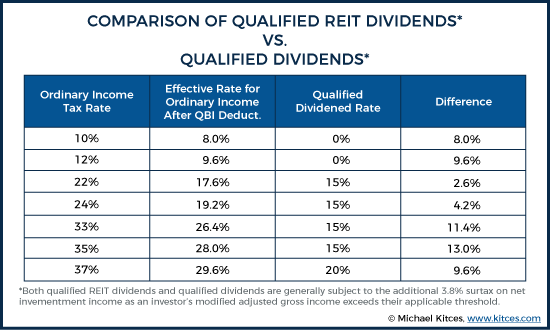

Section 199a Qbi Deductions For Reits Vs Direct Real Estate

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How Dividend Reinvestments Are Taxed

Section 199a Qbi Deductions For Reits Vs Direct Real Estate

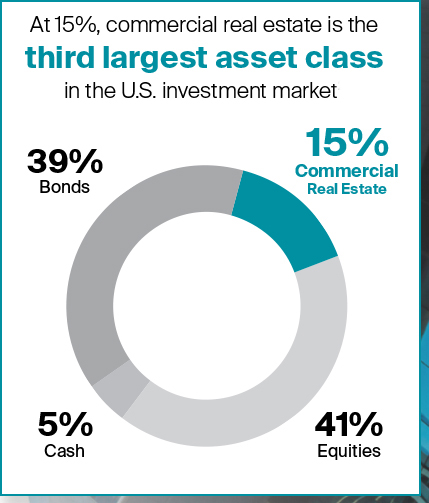

Why Invest In Reits Benefits Of Reit Investing Nareit

Your Dividend Tax Rates 3 Examples Calculate Tax On Your Qualified Dividends Like A Pro Youtube